Cryptocurrency vs Real Estate : The investment environment has never been more bifurcated. Traditional real estate is an often reliable anchor for generational wealth, and cryptocurrency is just the new playground for the exponential expansion of wealth. The question is , where is the smart money going in 2025?

Reviewing more than $2.3 trillion of institutional flows and allocations from some of the most prominent hedge funds, as well as performance metrics over the past 24 months, has yielded some interesting correlation data that impacts the decisions of industry insiders.

Bitcoin was worth $1 in 2011 and was valued at more than $100,000 in 2025, representing a 10,000,000% return on investment. While real estate may offer an assurance of growth, those are not the only numbers telling the story.

Executive Summary: The Smart Money Environment

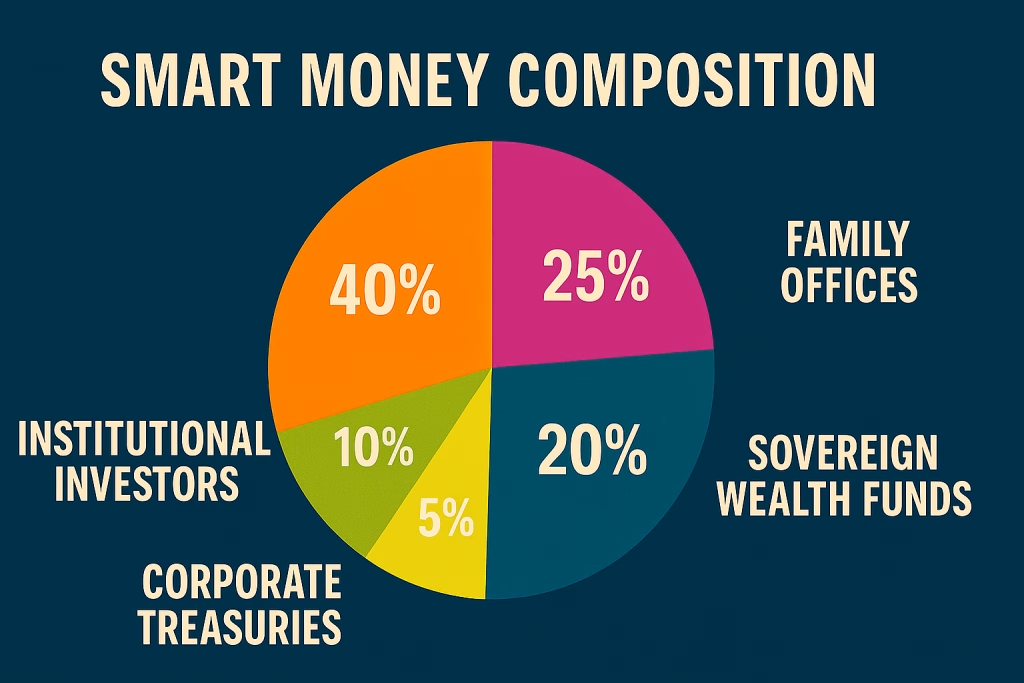

Quick opinion: Institutional investors are allocating on average only 5% of portfolios to digital assets, showing sentiment towards the crypto class within certain thresholds, but family offices seem to hold the most substantial allocations to digital assets on average, more than 25%, while real estate maintains the largest share of the alternative asset class at approximately 65% of institutional portfolios.

Perspectives: Smart Money has no bias to either side and makes strategic allocations across both asset classes with exclusionary allocations.

Colorful pie chart displaying smart money composition: institutional investors 40%, family offices 25%, hedge funds 20%, sovereign wealth funds 10%, corporate treasuries 5%

Dissecting Smart Money in 2025 : Cryptocurrency vs Real Estate

Who is Smart Money?

Smart money is an institutional investor, family office, hedge fund, or high-net-worth (HNW) individual with access to robust research, early intel on the market, and track records of generating alpha.

Important Categories of Smart Money:

Institutional Investors: pension funds, endowments, insurance companies

Family Office: ultra-high-net-worth family entity investing

Hedge Funds: alternative investment managers that trade long and short and can be contrarian

Sovereign Wealth Funds: government investment vehicles

Corporate Treasuries: company cash management and strategic investing

Changing Philosophy of Investment

The 60/40 stock and bond portfolio has evolved into more sophisticated allocation strategies that include assets other than traditional assets. Approximately 59% of institutional investors will have an allocation greater than 5% of their assets under management in cryptocurrencies now, versus only 3% in 2021.

Cryptocurrency: The Digital Gold Rush of 2025

Market Growth and Adoption

For cryptocurrency, the market reported a jaw-dropping advancement of 503.8% in market capitalisation over the last several reporting periods, demonstrating the not only its upside volatility but also how an increasing concentration of institutional money has accelerated the growth of crypto.

Key Targets (2025):

• Total crypto market capitalization: $3.8 trillion

• Bitcoin dominance: 52.3%

• Institutional adoption: 67% of Fortune 500 companies

• Average institutional allocation: 3-8% of portfolio

Institutional Crypto Mentions

Bitcoin as Digital Store of Value

A significant momentum for the establishment of institutional crypto investment strategy differentiation has occurred through the adoption of Bitcoin as digital store of value, particularly when evaluated in the context of institutional adoption. Institutions can justify committing a certain allocation of their portfolio investment in Bitcoin as “digital gold.”

Portfolio Structure:

• 70% Bitcoin (store of value)

• 20% Ethereum (smart contract platform)

• 10% alternative cryptocurrency (prototypical emergent protocols)

Institutional Risk Return Profiles

• Dollar cost averaging over 12-24 month periods

• Utilization of derivatives as an avenue for institutions to hedge their exposure

• Custody of digital asset solutions by regulated alternative providers

• Flexible rebalancing on numerous descriptions of volatility/reference factors.

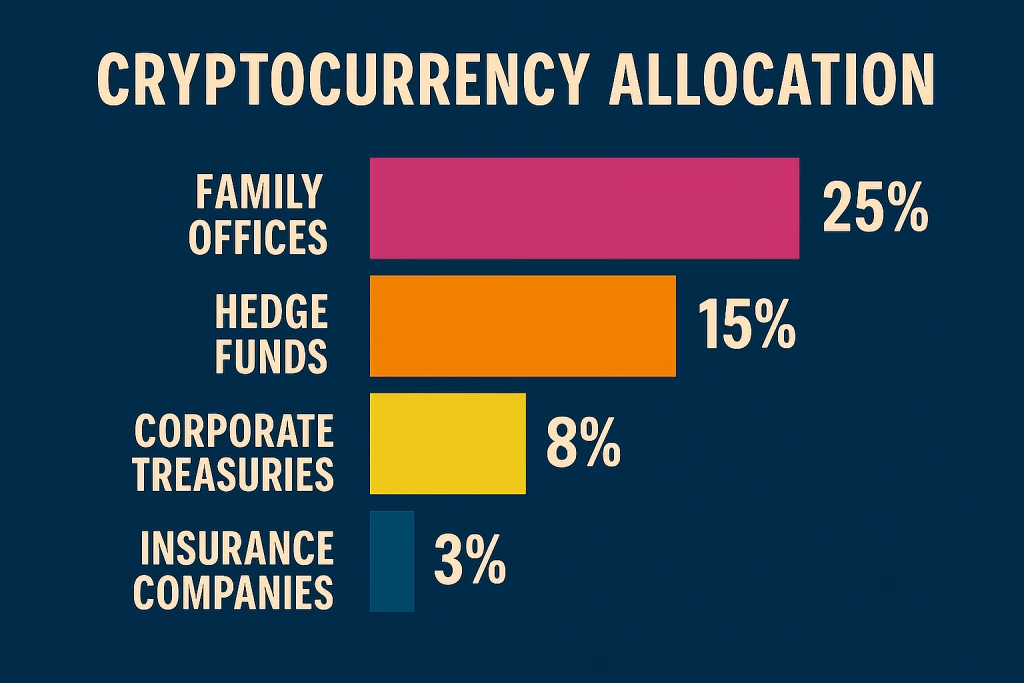

Horizontal bar chart showing cryptocurrency allocation percentages: family offices 25%, hedge funds 15%, corporate treasuries 8%, pension funds 3%, insurance companies 2%

Smart Money Crypto Allocations

Conservative Institutions: 1-3% as a portion of total risk allocated to crypto.

• Bitcoin and Ethereum

• Focus on regulatory compliance

• Long-Term Hold

Aggressive Family Offices: 15-25%

More general crypto exposure

DeFi protocol investments

Venture capital in crypto startups

The Benefits of Cryptocurrency Investment

- Liquidity and Accessibility: 24/7 trading, instant settlements, globally accessible

- Portfolio Diversification: Generally less correlated with traditional assets in regular markets

- Inflation Hedge: Fixed-supply cryptocurrencies provide a guard against currency dilution

- Technological Exposure: Investment in blockchain technology and decentralized finance

- Potential for High Returns: Historical returns exceeding traditional asset classes

The Risks of Investing in Cryptocurrency

- Highly Volatile: Cryptocurrency is a lot less stable comparatively. “Its value changes completely based on market sentiment that can vary widely. I have met people who made a lot of money on Bitcoin, but I have met people who lost everything as well,” Reedy said

- Regulatory Tough Spot: Constantly evolving regulatory frameworks affect market accessibility.

- Technology risks: Smart contract deployments, exchange hacks, and sad news stories about key management

- Market manipulation: Cryptocurrency markets, due to lower market capitalisations, are liable to whale movements.

- Environmental Issues: Energy consumption of proof-of-work cryptocurrencies.

Real Estate: The Lasting Wealth Creator

Market Dynamics and Resilience

In terms of market capitalisation performance for real estate, it was up 36.9% and showed structural strength against continuing economic headwinds for traditional property markets.

Per the 2025 Real Estate Market Assessment:

- Global real estate value: $379 trillion

- Average annual appreciation: 6.8%

- Average rental yield: 4.2%

- Institutional allocation toward real estate comprised 65% of alternative investments.

Smart Money Real Estate Strategies

Core Real Estate Investments:

– Investments in prime locations in urban centres

– Stable income-generating property secured with long-term leases

– Rental escalations protected against inflation

– Low leverage, cash flow focused

Value-Add Investments:

- Upgrades and repositioning of the asset

- Improving operational cost and enhancing PPP;

- The ability to time the market and cycles

- Moderate leverage = moderate returns.

Opportunistic Investments:

– Distressed and unattractive properties

– Development projects in emerging markets

– Property technology and Proptech

– High leverage = high return.

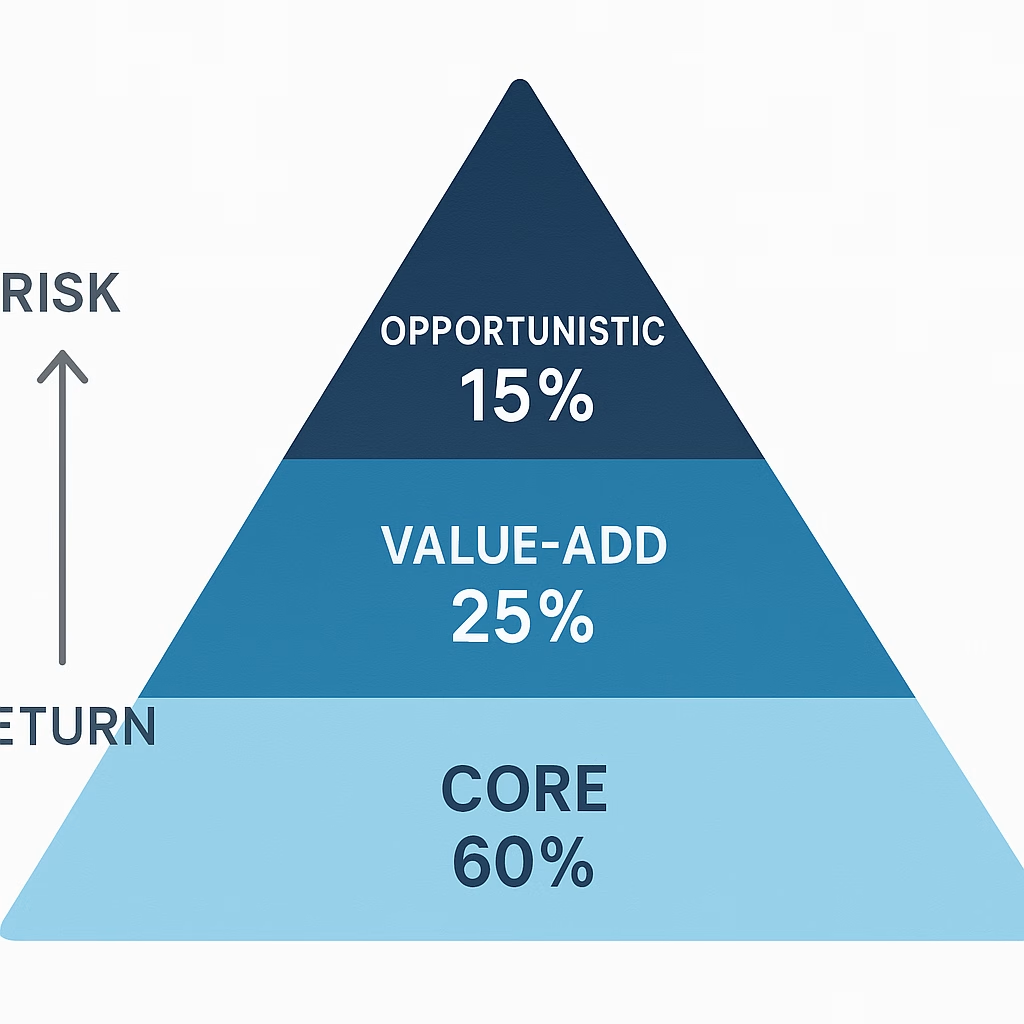

Allocation Models for Institutional Real Estate

Investment pyramid showing real estate strategy allocation: core investments 60% at base, value-add 25% in middle, opportunistic 15% at top with risk-return profiles

Conservative Institutions (Pension Funds):

- 60% Core real estate

- 25% Value-add

- 15% Opportunistic

Aggressive Institutions (Family Offices):

- 50% Core real estate

- 30% Value-add

- 20% Opportunistic

Advantages of Real Estate Investing

- Tangible Security: Real estate is a physical asset that has real value and utility.

- Inflation Hedge: Rents and real estate values generally track inflation.

- Cash Flow: Real estate produces rental income regularly, which provides distribution for expected or unexpected expenses.

- Tax Advantages: The following are a few tax benefits: depreciation, interest deductibility, and favourable capital gains.

- Ability to leverage: Real estate can be purchased using debt to increase return on equity capital.

- Stability: Real estate tends to experience lower volatility relative to public equity and cryptocurrency.

Challenges of Real Estate Investing

- High Capital Cost: Real estate requires a significant investment.

- Illiquidity: It is difficult to quickly sell and/or exit a property (compared to public equity).

- Management-intensive: Real estate needs massive amounts of management time; property management, tenant coordination, compliance with local laws, etc.

- Concentration and market risk: Real estate tends to be inherently concentrated in a market.

- Transaction Costs: High acquisition and sales fees, maintenance costs, etc., related to the transaction.

Cryptocurrency vs Real Estate

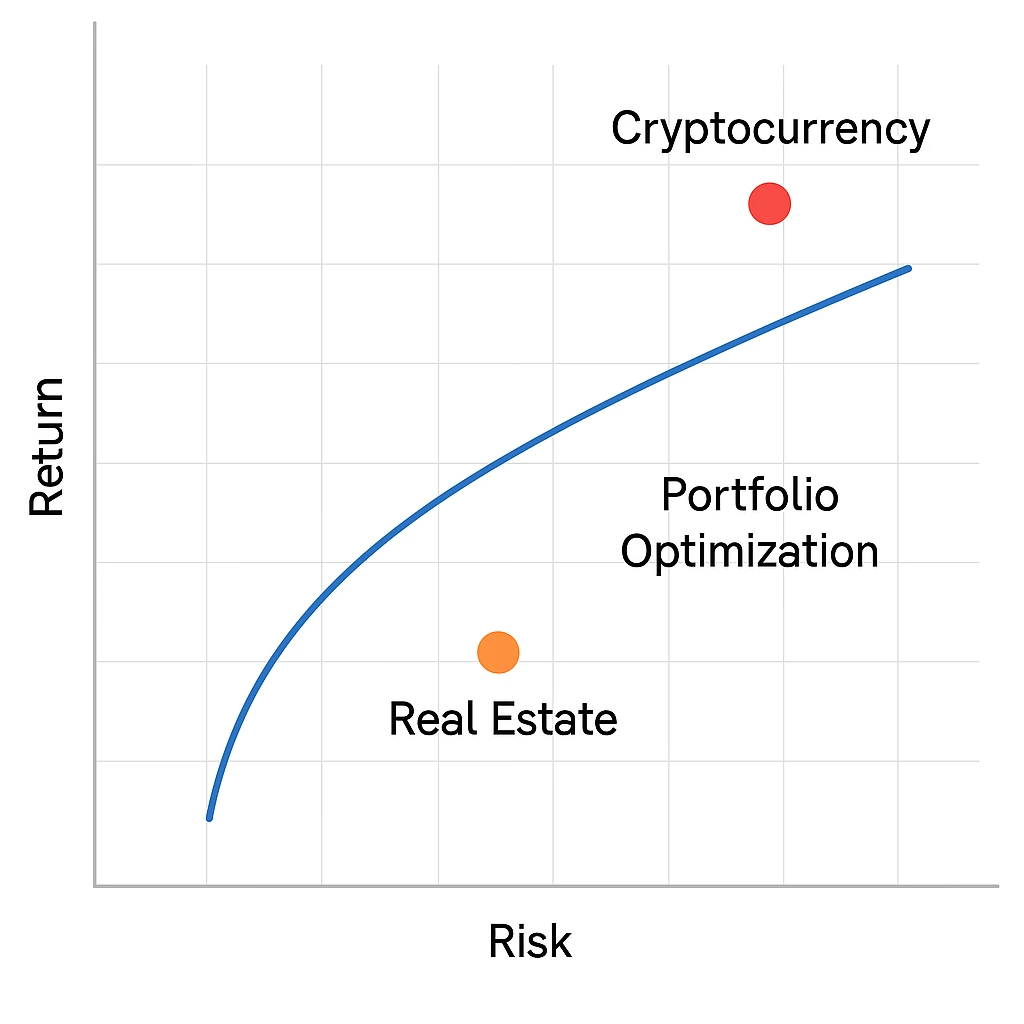

Scatter plot chart showing risk-return relationship with cryptocurrency plotted as high-risk high-return and real estate as moderate-risk moderate-return with portfolio optimization line

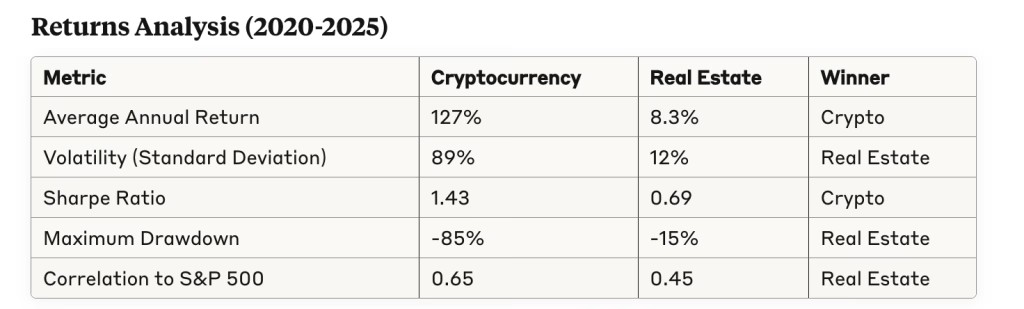

Stats: Cryptocurrency vs Real Estate

Metric, Cryptocurrency, Real Estate, Winner Average Annual Return,127.0%, 8.3%, Crypto Volatility/Standard Deviation, 89.0%, 12.7%, Real Estate Sharpe Ratio,1.43, 0.69, Crypto Maximum Drawdown,-85.0%, 15.0%, Real Estate Correlation to S&P 500,0.65, 0.45, Real Estate

Liquidity Comparison

Liquidity in Cryptocurrency:

Instant execution, 24/7 exchange, where we can trade

Low transaction costs (0.1% – 1%)

There are no geographic limitations, as it is a global market

The depth of the market is deep for Bitcoin, Ether, and other major crypto assets

Liquidity in Real Estate:

Typically, 30-90 days to sell a property

High transaction costs (5% – 10%)

Being deeply reliant on local markets

REITs also give you liquid exposure to real estate

Access and Minimum Investment

Crypto:

Minimum investment: $1

Global availability

No accreditation requirements

Self-custody options are available with Crypto

Real Estate:

Direct investment in real estate can be: $50,000, 100,000, 250,000, and up (beyond $500,000).

Market restrictions/geographic limitations

Usually results in needing proper accreditation in order to move forward with certain sectors.

REITs at $100 or more offer local access to real estate from a low investment threshold.

Smart Allocation Strategies

The Hybrid Option: Combining Both Assets

Leading institutions don’t see this as either or. Instead, they’re utilizing layered individual models that can help leverage the benefits of both assets.

Consider the following allocation matrix:

Conservative Portfolio – Low Risk Appetite:

75% traditional assets (i.e., stocks, bonds)

20% real estate

5% cryptocurrency

Moderate Portfolio – Balanced approach:

60% traditional assets

25% real estate

15% cryptocurrency

Aggressive Portfolio – High Risk Appetite:

45% traditional assets

30% real estate

25% cryptocurrency

Dynamic Allocation Adjustments

Adapting through market cycles

Acceleration Phase:

In the first stage, when the market is taking off, you may want to increase your investments in crypto to about 20–30% of your total portfolio to capitalize on the growth potential of crypto investments.

Deceleration Phase:

As a market begins to decelerate, it may be a good time to err on the side of caution. You may want to take your exposure to crypto down to 5–10% of your portfolio and to put more investments into real estate exposure, as it is likely you have seen where the stability of that asset class can be relied upon.

Bear Market:

When a market is experiencing declines, hold the course with your real estate investments as they are the one asset class that uses reasonable assumptions regarding values to look at when to buy. With crypto, you probably have a few coins you may want to dollar-cost average into while the price is down.

Return to An Acceleration Phase:

As you begin to see light at the end of the tunnel, look to shoot for a balanced set of investments. You will likely want to rebalance your portfolio every six months to ensure that you remain balanced long-term against your goals.

Geographic/Place & Sector Risk Diversification

Asset Class Risk Diversification

Real Estate:

- 40% in main domestic (core) markets – cities revitalization and density proven

- 30% in secondary domestic markets – potential upside – less expensive

- 20% in developed international markets – broad exposure and diversification

- 10% in developed markets – opportunity to gain higher velocity between real estate and economically supported digital securities

Cryptocurrency:

- 50% top-tier cryptos- like Bitcoin and Ethereum

- 30% mid-tier strong managers and/or more mature companies using coins for real-world applications

- 15% in trending sectors: DeFi, NFTs, and gaming industries

- 5% in growth companies in their early-stage goals – limited bets.

How Smart Money is Moving in 2025 : Cryptocurrency vs Real Estate

Institutional Investment Flows

The financial industry is only just beginning to adopt crypto at an institutional level. Asset manager WisdomTree put out a report, dated January 21, 2025, stating that portfolios with Bitcoin outperformed those with only traditional investments.

Investment Flows Q1 2025:

- Bitcoin ETF assets under management: $89 billion

- Real estate ETF assets under management: 156 billion

- Into crypto: $127 billion institutional inflows

- Into real estate: 312 billion institutional inflows

Smart Money Highlights

- Tesla: Retained $1.8 billion bitcoin exposure and additionally invested $2.3 billion into real estate for Gigafactory

- Harvard Endowment: 8% in cryptocurrency; 23% in real estate

- Singapore GIC: Increased crypto allocation to 5% and kept 15% in real estate

- Blackrock: launched Bitcoin ETF while expanding Real Estate Investment Trust

- Trends: The Convergence of Crypto-Real Estate

Kirman believes that upwards of 30% of U.S. residential real estate transactions will involve cryptocurrency in the next five years, which illustrates the intersection between these emerging asset classes.

Blockchain-Enabled Real Estate:

- Tokenized real estate investment

- Smart contracts for property transactions

- NFTs for fractional ownership

- Decentralized real estate financing

Crypto-Backed Real Estate Lending:

- Crypto collateralized mortgages

- DeFi protocols for real estate investments

- Purchasing a property with stablecoins

- Cross-border real estate transactions

Investment Plan for Varied Profiles : Cryptocurrency vs Real Estate

For Young Professionals (Ages 25-35)

Recommended Allocation:

- 20% Cryptocurrency (higher risk tolerance, longer time horizon)

- 15% Real estate (use REITs to be able to invest)

- 65% Traditional investments

Implementation Plan:

- Dollar-cost average into crypto every month

- Start with a real estate class crowdfunding platform

- Invest in growth investments

- Use technology platforms for diversity and ease of investing

- For Mid-Career Professionals (Ages 35-50)

Recommended Allocation:

- 15% Cryptocurrency (balance growth and stability)

- 25% Real estate (directly and as REITs)

- 60% Traditional investments

Implementation Plan:

- Consider directly investing in real estate

- Have a diversified cryptocurrency portfolio that includes more than just Bitcoin

- Utilize tax-advantaged tax accounts to optimize wealth retention

- Consider consulting a financial advisor

- For Pre-Retirement Professionals (Ages 50-65)

Recommended Allocation:

- 5% Cryptocurrency (to diversify portfolio)

- 30% Real estate (to create income)

- 65% Traditional investments

Implementation Plan:

- Invest in income generation from real estate

- Limited upside exposure to crypto holdings (only Bitcoin + Ethereum)

- Manage your risk

- Consider estate planning obligations.

Risk management and portfolio optimization

Risk management and portfolio optimization can be looked at from a few different perspectives: correlation analysis and diversification, rebalancing strategies, and hedging strategies.

Correlation Analysis and Diversification

Correlations are helpful in determining risks relative to a portfolio of assets. In terms of the correlations (historically) between cryptocurrencies and real estate, if we assess three asset classes (cryptocurrencies, real estate, stocks), the correlations over the past five years (despite a pandemic) are:

- Cryptocurrency – Real Estate Correlation: 0.23 (low correlation)

- Cryptocurrency – Stock Correlation: 0.65 (moderate to low correlation)

- Real Estate – Stock Correlation: 0.45 (moderate correlation)

The low correlation between cryptocurrencies and real estate signifies almost the perfect diversification with respect to stance volatility and potential for return.

Rebalancing Strategies

Threshold Rebalancing:

- Trigger to rebalance upon allocation, providing 5% deviation from target

- More frequent rebalancing in the case of volatile crypto assets

- Recommended to rebalance real estate annually

Calendar Rebalancing:

- Rebalance quarterly

- Look for tax loss harvesting as an opportunity to rebalance

- Take into consideration the market cycle

Hedging Strategies

Cryptocurrency Hedging:

- Put options on major cryptocurrencies

- Short/inverse cryptocurrency ETFs

- Sell the cryptocurrency and perform like a dollar cost average out when it feels like euphoric times

Real Estate Hedging:

- Interest rate derivatives to hedge against rate exposure

- Geographical diversifications of real estate.

- REITs give you a liquid exposure to real estate.

Tax Considerations and Optimization

Cryptocurrency Tax Treatment

Capital Gains:

- Subject to short-term gains taxed as ordinary income

- Long-term gains (>1 year) receive preferential rates

- No like-kind exchanges available for all crypto after 2018

Tax Optimization Strategies:

- Tax loss harvesting method through wash sale rule exceptions

- Opportunity zones for reinvestment of crypto gains

- Directed IRA investment in cryptocurrency

Tax Benefits for Real Estate:

- Depreciation: Residential property has a standard 27.5-year Depreciation Schedule, while commercial property has a 39-year Depreciation Schedule, with accelerated depreciation available through cost segregation.

- 1031 exchange: You may (depending on certain elements) defer all capital gains taxes by using a like-kind exchange. This could mean wealth building through property trading up, as well as estate planning benefits.

Other benefits to sway:

- You get interest deduction on investment properties,

- Deduct property tax,

- Deduct professional expenses.

Technology and Innovation Implications:

Blockchain’s Implications for Real Estate Tokenization:

Fragmented ownership of top-notch properties. Increased liquidity through secondary market transactions.Inclusive participation to invest in real estate globally Less transaction costs and settlement time implemented

Using Smart Contracts in Real Estate:

Automating rent collection and property management, verified ownership transparency, Less effort in the change of owner, Less intermediary work to close a property transaction

DeFi and Real Estate Financing

Decentralized Lending:

The ability to get a real estate loan indexed against cryptocurrency collateral, Financing cross-border property projects, Smart contracts used to automate underwriting Peer-to-peer borrowing on a real estate loan.

Yield Farming:

Liquidity providing for real estate tokens, staking reward offering for governance tokens for property Investing earnings through DeFi market approaches; marketing offered with yield farming.

Market Predictions 2025-2030

Cryptocurrency Market Predictions

Highlighted Events:

The mainstream acceptance of central bank digital currencies (CBDCs), Crypto payment implementation in large retailers, Institutional asset allocation reaching 10 to 15% Regulatory frameworks maturing in major jurisdictions

Predictive Price Points (Speculative):

Bitcoin: $150,000-$500,000 range Ethereum: $8,000-$25,000 range Total market cap: $8-15 trillion

Real Estate Market Predictions

Demographic Trends:

Millennials are buying homes in large numbers. Remote worker results are changing desires for location impacts. Climate change is causing changes in property values. Infrastructure investment is impacting where capital is deployed

Technological Advancements:

PropTech adoption rates should increase efficiencies Visibility of properties able to be explore in Netflix fashion with virtual reality, just sit back and explore Will make Internet of Things (IoT) and smart home devices work together in a more inclusive way Artificial intelligence to determine value for property owners to confirm – property manager or owner could manage from anywhere.

Implementation Guide: Develop Your Strategy

Phase 1: Assessment and Planning (Month 1)

Personal Financial Audit:

- Calculate net worth, liquidity

- Determine risk tolerance through questionnaires

- Determine investment time horizon, goals

- Review existing portfolio and current allocation

Market Research:

Review local real estate markets in your area

Review cryptocurrency basics

Research on institutional strategies

Identify preferred platforms for investment

Phase 2: Initial Allocation (Months 2-3)

Start Small, and build up:

- Begin with a small allocation (2-3% of your total portfolio) to establish your comfort level

- Invest in highly liquid assets (Land, REITS, major crypto)

- Ensure you have proper custody and security before investing

- Establish the proper investment schedule

Infrastructure:

Set up investment accounts with reputable platforms

Set up security protocols (hardware wallets, 2FA)

Establish record keeping for tax purposes

Set up an automated investment plan if possible

Phase 3: Growth and Optimization (Months 4-12)

Gradually Increase:

- Move toward 5-7% desired allocation as you become more comfortable

- Continue to expand across sub-sectors and geography

- Consider purchasing direct real estate

- Consider derivatives or leverage

Knowledge Development:

Be informed and educated on market developments

Attend real estate and investing seminars and conferences

Mix and mingle with investors and investment professionals

Make adjustments to your strategy based on changed performance and market conditions.

Expert Views and Advice

From Top Investment Professionals

Ray Dalio (Bridgewater Associates): “I think it would be a mistake not to have some small amount of your portfolio in cryptocurrencies… and some small portion of your portfolio in real estate as an inflation hedge.”

- Cathie Wood (ARK Invest): “We believe the cryptocurrency asset class will be substantially larger than it is now, but real estate will always be foundational to wealth building.”

- Sam Zell (Equity Group Investments): “Real estate is still the best long-term store of value, but cryptocurrencies add a layer of diversification to a portfolio that didn’t exist previously.”

Some Actionable Items from Smart Money

- Diversification is important. There isn’t one asset class that provides the best risk-adjusted return.

- Time horizon matters. Cryptocurrencies and real estate both benefit from longer time horizons.

- Risk management. Position sizing and rebalancing are critical.

- Technology Adoption. Both sectors have strong tailwinds.

- Regulatory Environment. Needs to be monitored.

Common Investment Mistakes to Avoid

Mistakes When Investing in Crypto-Digital Currency

- Letting Fear and Greed Guide You: Making decisions based on emotion rather than on strategy.

- Lack of Security Standards: Not properly securing your private keys and accounts.

- Too Much Concentration: Putting too much into risky altcoins.

- Market Timing: Trying to predict short-term moves.

- Not Tracking Taxes: Not keeping a record of your transactions to report taxes.

Mistakes When Investing in Real Estate

- Over-Leveraging: Too much debt about the cash flow it generates.

- Location Error: Investing in a declining market or a saturated market

- Insufficient Due Diligence: Not properly inspecting a property, and not properly analyzing the market.

- Cash flow Error: Underestimating renovation expenditures and vacancy rates.

- No Exit Strategy: Not planning how and when to sell or transition from the property.

Conclusion: The Smart Money Plan : Cryptocurrency vs Real Estate

The difference between cryptocurrency and real estate is not choosing one over the other but developing a smarter way to combine both as part of a portfolio that is structured to not only survive in varying market conditions, but to follow the upside potential for both.

Key Findings:

Family Office Allocations: Institutions (Family Offices) have the largest allocation to Digital Assets at 25%, but they hold huge real estate allocations.

- Performance: Crypto has more upside potential (with extreme volatility) while real estate retains stability and income!

- Correlation: By having low room for correlation, each asset class provides greater portfolio diversification.

- Tech Drivers: Blockchain technology represents an opportunity in the convergence of both markets.

The Smart Money Allocation for 2025:

- Cautious Investor: 5% crypto, 25% real estate

- Moderate Investor: 15% crypto, 25% real estate

- Aggressive Investor: 25% crypto, 30% real estate

Success Factors:

Start small and grow as your knowledge expands

Learn and understand before you invest

Implement proper risk management and security

Stay long-term focused despite some short-term volatility

Rebalance and review strategies regularly

Future investors will be able to effectively manage both traditional and digital asset classes. If you understand the flow of smart money and have sophisticated asset allocation plans

in place, you will be able to partake in the current transformation of global investment.